The federal funds.

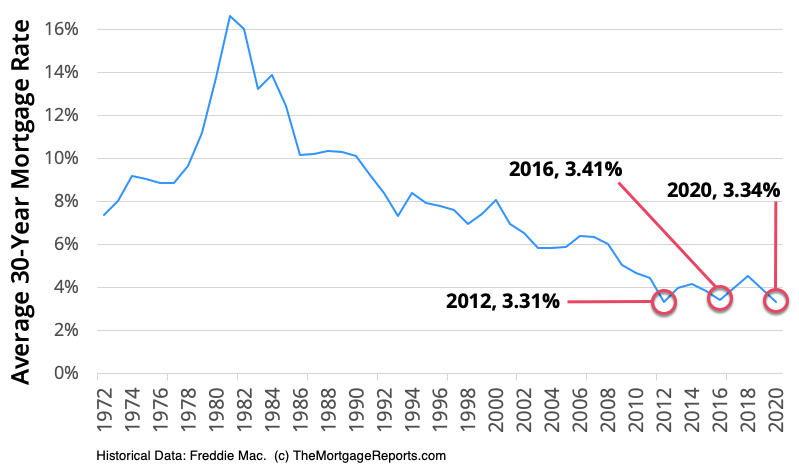

rate, nevertheless, doesn't directly affect long-term rates, that include financial products like 30-year fixed-rate home mortgages; those tend to move with the 10-year Treasury yield. A home mortgage rate lock freezes the rate of interest. 2019 timeshare calendar The loan provider warranties( with a couple of exceptions) that the home mortgage rate used to a customer will remain available to that debtor for a stated amount of time. Nevertheless, there are in advance costs associated with refinancing, such as appraisals, underwriting charges and taxes, so you'll desire to make certain the savings outmatch the refinancecost tag in a reasonable amount of time, say 18 to 24 months. Discover more about re-finance rates here. Perhaps you're looking to purchase a fixer-upper, or re-finance your home loan or tap your house equity to money repair work on the home you already have. 203( k )home loans and similar products are created to let you purchase a home and.

finance necessary repairs under a single loan umbrella. There specify sort of work these loans need to be utilized to cover, so make sure your project fits the requirements. You can likewise do a cash-out re-finance of your existing home loan, open a home equity credit line( HELOC) or take out a house equity loan to pay for remodellings. The fell 3 basis points to 2. 96% from a week ago. The increased 1 basis point to 2. 40 % from a week ago.

Extra mortgage rates can be found in the chart and graph below. 3-month pattern 12/16/2020 2. 960% 2. 400% 2. 890% 3. 420% 12/9/2020 2. 990 %2. 930 %3. 400 %12/2/2020 3. 000% 2. 420% 3 - what types of mortgages are there. 020% 3. 440% 11/25/2020 3. 010% 2. 440% 3. 010% 3. 440% 11/18/2020 3. 030% 2. 450% 3. 050% timeshare worth 3. 460% 11/11/2020 3. 120% 2. 500% 3. 080% 3. 480% 11/4/2020 3. 040% 2. 470% 3. 010% 3. 480% 10/28/2020 3. 460% 3. 010% 3. 490% 10/21/2020 3.

What Is Today's Interest Rate For Mortgages Can Be Fun For Everyone

060% 2. 470% 3. 090% 3. 490% 10/14/2020 3. 050% 2. 470% 3. 090% 3. 500% 10/7/2020 3. what are today's interest rates on mortgages. 080% 2. 530% 3. 070% 3. 480% 9/30/2020 3. 050% 2. 490% 3. 170% 3. 500% 9/23/2020 3. 100% 2. 530% 3. 200% 3. 520% 9/16/2020 3.

530% 3. 210% 3. 550% Lenders charge interest on a home mortgage as a cost of lending you cash. Your mortgage rate of interest identifies the amount of interest you pay, in addition to the principal, or loan balance, for the term of your home mortgage. Home loan rates of interest determine your regular monthly payments over the life of the loan.

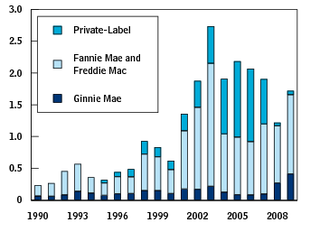

To guarantee you're getting precise existing home loan rates, ensure you're comparing comparable loan price quotes based on the precise term and item. Home mortgage can be found in variations of these categories, and home loan rates can vary by loan type: include home loans guaranteed by the Federal Real Estate Administration( FHA loans) and home loans ensured by the Department of Veterans Affairs (VA loans )and the Department of Farming( USDA loans). These loans have lax credentials criteria and are appealing to first-time home purchasers. tend to be plain-vanilla mortgage that fulfill certifications set by home mortgage giants Fannie Mae and Freddie Mac. They normally have greater minimum credit history than government-backed loans.

Fascination About Which Of The Following Statements Is True Regarding Home Mortgages?

Home loan rates for these loans can be beneficial due to the fact that loan providers normally believe they are lending to lower-risk borrowers. A fixed-rate loan has one rate of interest over the life of the home mortgage, so that the month-to-month principal-and-interest payments stay the same until the loan is paid off. ARMs typically start out with a low rates of interest for the very first couple of years, but that rate can go higher. MORE: The term is the variety of years it will take to buying a timeshare pay off the home mortgage. The most common home mortgage term is 30 years. Another alternative is the 15-year term, which is popular for refinancing.